Premier Hard Money Lender Atlanta: Tailored Funding for Success

Wiki Article

Fast and Adaptable Financing: the Benefits of Dealing With a Difficult Money Lending Institution

Rapid and adaptable financing is right at your fingertips when you function with a difficult cash lending institution. Plus, the flexible financing terms supplied by tough money lenders allow you to customize a repayment plan that functions for you. Experience the benefits of working with a difficult money loan provider today!

Quick and Easy Application Process

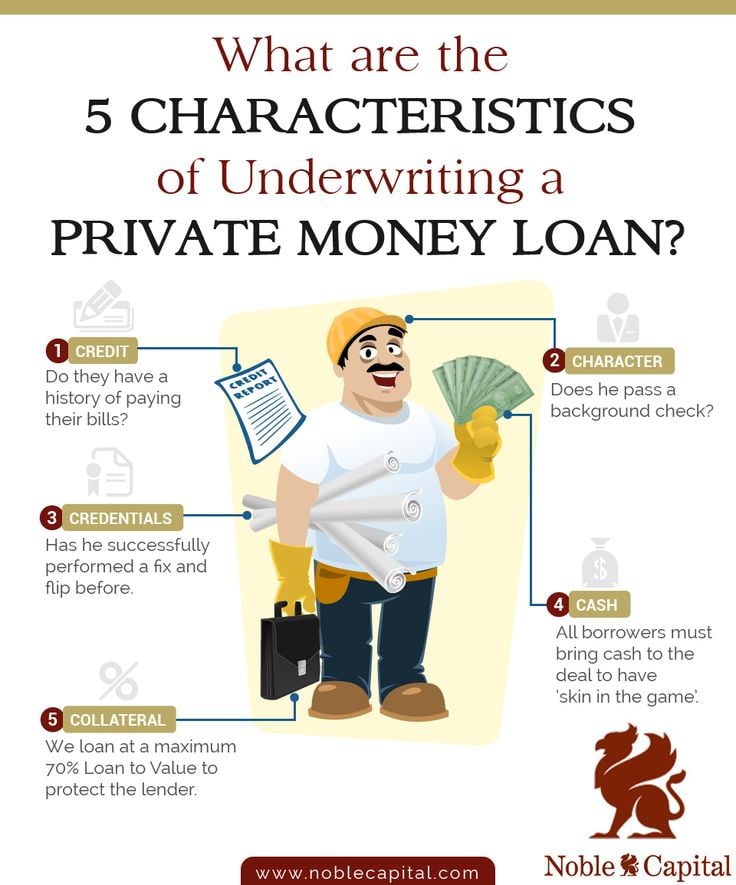

If you're seeking rapid and adaptable financing, you'll appreciate the quick and very easy application process when working with a hard money lender. Unlike conventional loan providers, who usually need considerable documents and a prolonged approval procedure, tough cash lenders understand that time is important when it pertains to securing financing for your job. With a tough cash lender, you can expect a structured application process that allows you to obtain the funds you need in a portion of the moment.To begin the application procedure, you'll generally require to supply standard info about on your own and your job. Unlike standard loan providers, difficult money loan providers are mostly concerned with the value of the building and your ability to pay back the lending, instead than your credit score history or income.

When you've sent your application, a difficult cash loan provider will quickly review your info and analyze the value of the building. This expedited procedure permits a faster approval and funding timeline, frequently within days rather than months or weeks. This can be a game-changer for genuine estate capitalists and designers who need funds rapidly to confiscate time-sensitive opportunities.

Higher Approval Rates

You'll value the higher authorization prices when functioning with a hard money loan provider. Unlike typical banks that have strict financing requirements and extensive authorization processes, tough money lenders are a lot more focused on the worth of the residential property itself.Hard cash lenders prioritize the security, such as realty, over your individual economic circumstance. They recognize that circumstances can alter, and they are extra happy to deal with borrowers who might have had past economic troubles. This flexibility in their approval procedure makes tough money lenders an eye-catching alternative, especially for genuine estate capitalists or people who need quick access to funds.

With greater authorization prices, you can stay clear of the disappointment and taxing procedure of dealing with conventional loan providers. When other alternatives may not be available, hard money lenders can offer you with the monetary help you require. Whether you're looking to buy a property, renovate a fixer-upper, or fund a new project, functioning with a tough cash lending institution can offer you the greater approval rates that can make a significant difference in attaining your objectives

Versatile Financing Terms

:max_bytes(150000):strip_icc()/terms_h_hard_money_loan-FINAL-b9af7690939e45d5a80e25ee55c83d40.jpg)

One of the key benefits of working with a hard cash loan provider is their capacity to tailor financing terms to fit your special situation. They understand that every borrower is various and has differing monetary situations. This flexibility allows you to bargain terms that fit your particular requirements, such as settlement routines, rate of interest her latest blog rates, and security choices.

Fast Financing and Closing

When functioning with a difficult money lending institution,You can anticipate a rapid financing and closing process. Unlike traditional loan providers who might take weeks and even months to approve and money a loan, hard cash lending institutions recognize the relevance of speed in genuine estate transactions. They specialize in providing fast financing options to customers that need to shut deals promptly.

In enhancement to their quick financing, difficult cash loan providers also supply quick closing times. They recognize that time is important in real estate deals, and they prioritize closing sell a timely fashion. With their know-how and experience, they can expedite the closing procedure, ensuring that you can finalize your acquisition or refinance swiftly and smoothly.

Less Rigorous Credit Score Requirements

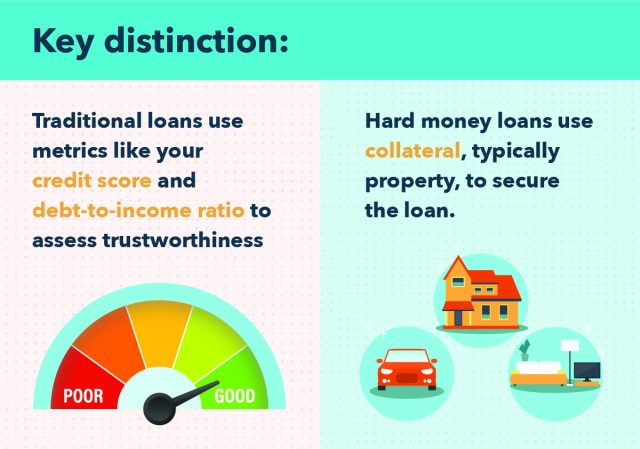

With a tough money loan provider, you can take advantage of their much less rigorous debt needs. Unlike traditional lenders who greatly rely upon credit history and economic background, hard money loan providers focus a lot more on the worth of the property being used as collateral. This implies that even if you have a less than outstanding debt rating or have actually encountered financial setbacks in the past, you still have a chance to secure financing.

Hard money lenders understand that negative credit scores does not necessarily click this link correspond to poor financial investment capacity. They are much more thinking about the potential success of the home and your ability to repay the car loan. This flexibility in credit history demands allows borrowers with incomplete credit report to still access the funding they need for their actual estate jobs.

By dealing with a hard cash loan provider, you can bypass the strict credit rating needs that standard loan providers impose. If you are a real estate financier or developer that needs fast access to funds, this can be specifically helpful. Rather than waiting weeks or perhaps months for lending authorization from a bank, tough cash lenders can give you with the funding you require in a matter of days.

Conclusion

So, if you need adaptable and quick funding, collaborating with a difficult money loan provider is the way to go. With their quick and very easy application procedure, higher authorization prices, flexible financing terms, quick financing, and less strict credit report requirements, you'll have the support you require to achieve your monetary objectives. Don't let typical lenders hold you back, accept the advantages of dealing with a hard money lending institution today.Unlike conventional loan providers, that frequently need extensive paperwork and an extensive authorization process, difficult cash lending institutions recognize that time is of the essence when it comes to securing financing for your job. Unlike typical lending institutions, hard money lenders provide more versatile and tailored loan options to meet you could try this out your particular requirements.Furthermore, difficult money loan providers typically have a quicker car loan approval procedure contrasted to typical lending institutions.By working with a difficult money lending institution, you can bypass the rigorous credit report demands that standard lenders impose. Do not allow standard loan providers hold you back, embrace the benefits of functioning with a difficult money lender today.

Report this wiki page